Grocery stores: Perpetual inventory inaccuracy & trends during COVID

- 5 minute read

- Retail Insight Team

Anyone who has worked in retail knows that in-store stock replenishment systems are only as good as the information you feed them.

First and foremost, store colleagues are responsible for accurately maintaining perpetual inventory (PI) values. Alongside forecasted demand and other factors, PI is a crucial component of the future order calculation, which determines how much stock a store receives on each delivery. Yet our research has found 56% of records are inaccurate, which presents an extraordinary opportunity for retailers who can get things right.

However, keeping PI records accurate across a large and complex item set is difficult. It requires constant shop floor and backroom maintenance and attention, in addition to instigating initiatives that attempt to suppress the underlying causes. Inaccurate PI has a knock-on effect on many of the key operational performance metrics such as on-shelf availability, sales, waste, shrink as well as capital and labor efficiency. Here we explore the impacts in more detail and highlight some unusual patterns identified during the COVID-19 peak purchasing period.

How overstated PI impacts on-shelf availability

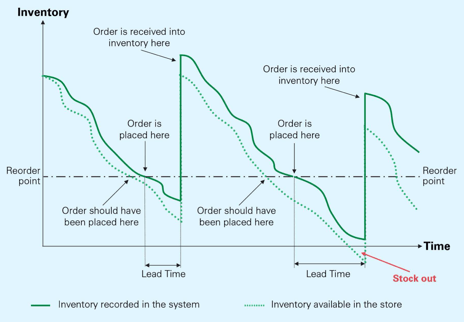

PI is overstated when the system value is higher than the physical stockholding. When this happens, stores receive insufficient stock to meet customer demand. On-shelf availability reduces along with sales. This issue compounds over time, such that decreasing sales erode future demand forecast. If the size of the error is small, an order may still be triggered. But, stock inevitably runs out. Consequently, customers see a yo-yo of on-shelf availability. See the illustration below:

Source: ECR Community Shrink & OSA Group

Source: ECR Community Shrink & OSA Group

Such poor reliability of availability leads to customer frustration, provoking them to switch allegiance to a substitute item, delay the purchase or worse abandon their basket altogether. Moreover, inaccurate records lead to online customers being misinformed as to product availability – leading to higher substitutions and associated costs. Accurate measurement of lost sales and on-shelf availability is one of the critical inputs to identifying and correcting inaccurate PI records.[i] Our research has found that 15% of lost sales are a result of inaccurate PI.

Impacts when PI is understated

When PI is understated, the PI value is lower than the physical stockholding. Understated PI can result in stores ordering more stock than is required, which has numerous consequences. With just-in-time supply chains, replenishment staff have two choices when faced with excess inventory. First, this stock can be forced onto the shelves, probably using space behind adjacent products, or second, cases are put on a returns cage for storage in the warehouse.

Having excess stock adds further to the risk of miscounting, and thus further corrupting PI values, including those adjacent products. Furthermore, stock rotation becomes either more time-consuming to carry out or merely impractical in the time replenishment staff have to complete the job. Consequently, this undermines date control procedures, increasing the risk that out-of-date products remain on the shelf, available for customers to purchase, or when found, are thrown.

The significant impacts of understated PI are the risk of waste, labor inefficiencies, and unnecessary capital tied up in inventory. If staff find the stock in time, using Intelligent algorithms to optimize a price markdown mitigates the loss, but does not eradicate it. Shrinkage is also at risk of increasing in overstock situations. Under-counting stock can create paper losses, and high stockholding increases the opportunity of more significant losses from theft, particularly for valuable items.

How can we detect inaccurate PI?

The analysis above shows that inaccurate PI in either direction is bad for the efficiency and effectiveness of the whole retail operation. Getting the basics right is key - such as training employees on the importance of their role in ensuring PI accuracy. However, even the most trained and diligent workforce make mistakes, and cyclical count routines do not pick up these mistakes or mis-deliveries quickly. Furthermore, cyclical counting is necessarily limited in scale and is carried out less frequently due to pressures on payroll costs.

In response to this challenge, Retail Insight has been testing a PI accuracy model that quickly identifies errors in PI records. We believe a data-led approach will have multiple benefits, the most important of which, is the speed of error detection and subsequent correction. Our recent analysis found PI inaccuracy on 56% of items on a SKU/Store/Day basis. This level of inaccuracy is similar to academic research[ii] that identified inaccuracy to be 65% in 37 stores. Similarly, industry research[iii] reported 60% inaccuracy. We are therefore confident that our model provides a robust means to address PI inaccuracy in a targeted, accurate, and continuous way.

PI during COVID-19

Given the importance of inventory records, especially during rapidly changing sales, we investigated changes to PI during the COVID-19 peak trading weeks. We identified an eight-fold increase in adjustments – with the removal of stock from PI outweighing additions by 20%.

The evidence suggests that many stores manipulated their PI at the beginning of the peak demand, to benefit from larger stock allocations of products in high demand – starting with toilet roll, then pasta and rice. Later, stores added the stock to the PI record, but for some time, supply chain teams were running blind as to the actual stock position.

In a nutshell

Accurate PI is essential to the quality of order calculations. Over-stated PI leads to stores receiving insufficient stock, reduced on-shelf availability, lost sales, and disappointed customers – both in-store and online. Under-stated PI leads to overstocked shelves, poorly rotated stock, additional manual handling, and waste. But maintaining accurate PI is challenging to achieve, and tools that identify inaccurate PI are scarce. Our analysis has identified significant operational and financial benefits to correcting PI quickly and maintaining its accuracy, and has found that data-driven tools such as the PI Inaccuracy Monitor provide a comprehensive and robust means to capture those benefits rapidly.

[i] Kang, Y. & Gershwin, S.B. (2004) “Information Inaccuracy in Inventory Systems – Stock Loss and Stockout”, Massachusetts Institute of Technology, White Paper.

[ii] DeHoratius, N. & Raman, A. (1998) “Inventory Record Inaccuracy: An Empirical Analysis”, Management Science, Vol 54, No. 4, pp.627-641

[iii] Rekik, Y, Syntetos, A.A., Glock, C.H. (2019) “Inventory Inaccuracy in Retailing: Does it Matter?” https://ecr-shrink-group.com/medias/research/ir/webinar-slide-show.pdf

Get in touch

Written by Retail Insight Team

Retail Insight takes data and turns it into action. Our advanced algorithms unlock valuable insights that drive better decision-making for retailers and CPGs.