The realities of retailing in 2023

- 6 minute read

- Irene Brockie

At Retail Insight, we are constantly looking to innovate and improve. We are focused on innovating across our product suite, continuously developing and advancing our solutions so that they deliver the highest possible benefit to our clients. We are also committed to improving our understanding of the retail and CPG industries, learning and refining our knowledge so that we can provide optimum value to our customers and key stakeholders.

In keeping with our commitment to learning, we obtained insights from over 100 retail executives to understand the issues that challenge them the most. The results were fascinating, providing an insightful view into the realities of retailing in a year which proved confronting for even the most established of grocers.

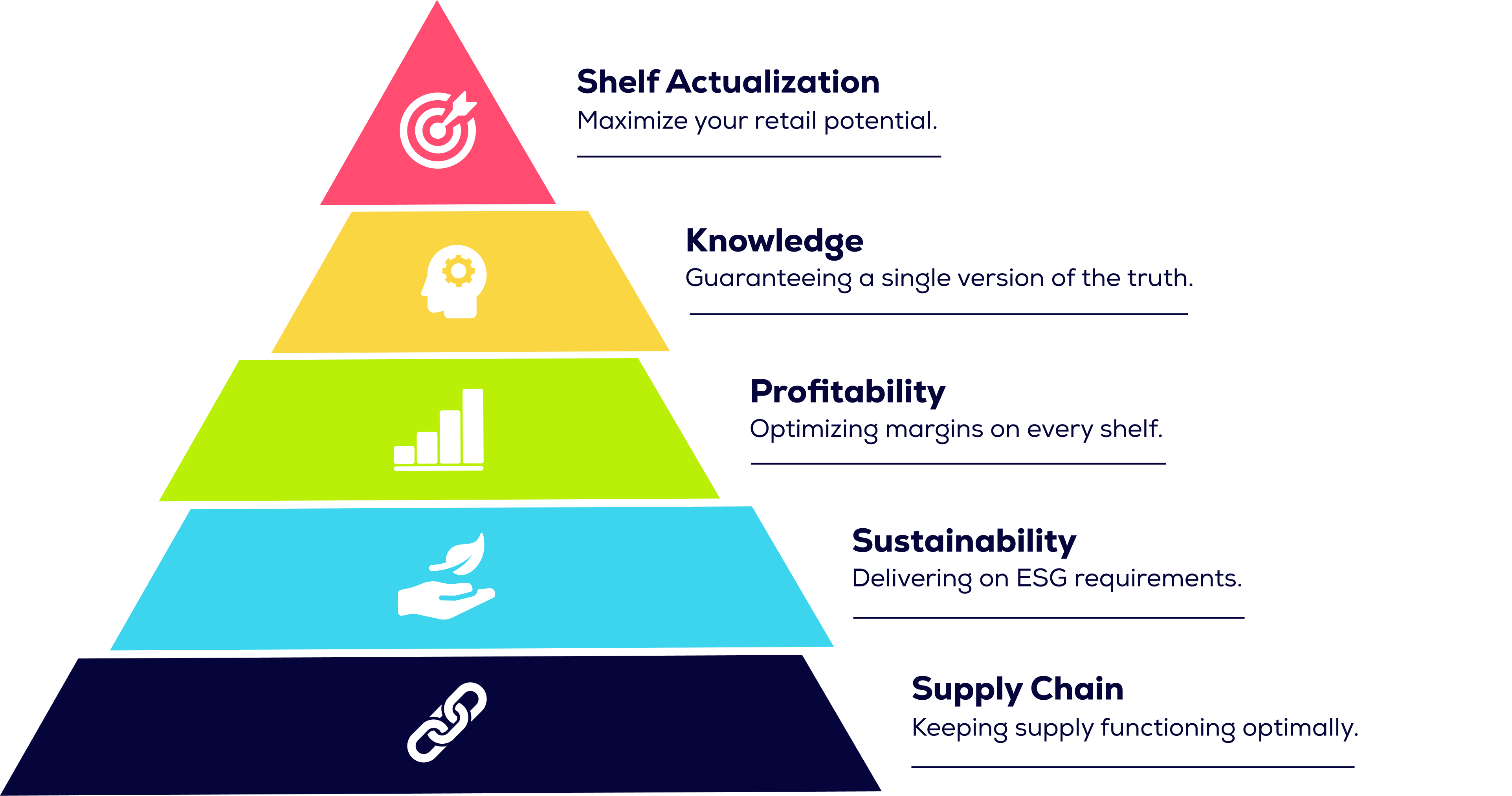

This research was undertaken as part of our Shelf Actualization campaign. Shelf Actualization occurs when retailers excel across four performance areas:

When retailers meet the needs of all four levels, their shelves reach their maximum potential - with the right items always available, products marked down at the right time, and minimal stock going to waste.

By contrast, stores that aren’t Shelf Actualized will tend to see many of the symptoms highlighted in our research, including:

- Manual, de-centralized markdown processes

- Lack of root cause insight for solving availability issues

- Shortage of actionable data causing store associate inefficiency

- Conflicting data sources preventing a single version of the truth

To measure Shelf Actualization, Retail Insight developed a Shelf Actualization Index, which retailers can use to quickly gauge their performance and see how close they are to achieving the gold standard.

We have divided the results into several categories – each linked to an operational theme.

The role of the store associate and the optimization of in-store labor

It is a truth universally acknowledged within the retail industry that reduced labor productivity = lower profits. Labor is usually recognized to be a retailer’s biggest expense (after COGS), generally considered to be +/- 10% of the average retailer’s sales1. Since the arrival of the COVID-19 pandemic in 2020, retailers have been grappling with both labor shortages and increased wage costs – two complex issues compounded and resulting in an array of challenges for retail players:

- Understaffed stores

- Reduction in customer satisfaction levels (due to dwindling shopper experience standards and a lack of trained, knowledgeable in-store associates)

- Talent shortage, leading to the recruitment of undertrained and underqualified staff

- Too much time spent on recruitment, to the detriment of other areas eg. Operations

- Impacted profit margins

The responses that we received highlight the extent to which compromised labor productivity and talent is impacting the success of individual retail stores. Only 55% of those surveyed agree that their associates always work on the most profitable tasks, whilst 58% agree that their store associates or employees know what to do in store that would have the highest impact on sales.

With just 56% of those surveyed agreeing that (their) store colleagues are clear with the replenishment tasks they need to do and when they need to do them, it is easy to see that communication is also a root cause of the productivity problem at hand. High employee churn rates are partly responsible – as store associates come and go, so too does the knowledge that they have acquired. Retailers that focus more intently on employee education and training will reap the rewards later and protect their time, money and reputation – particularly across areas such as item replenishment and stocktaking.

Where customer experience is concerned, only 58% of those surveyed agree that store associates have the right amount of time to ensure that customers have a best in class experience. If retailers were able to optimize in-store labor through the use of advanced technological solutions, the results would benefit profit margins, staff and shoppers alike. We count task and workforce management tools among the numerous tech solutions that are designed to cater to retailers, as well as software that seeks to optimize the efficiency of in-store operations e.g. our suite of transformational data solutions.

Focus on Food Waste Management

Food waste is an issue which continues to haunt grocery retailers, representing a huge leakage of revenue as well as negatively impacting environmental/sustainability commitments at a corporate level. We estimate that product waste costs a typical grocery retailer 2% of total store sales2.

Almost one in four (24%) respondents disagree that they have an optimal process for managing food waste, whilst only 63% agree that they always mark down the right products at the right time to the right price. These results signify the enormity of the dynamic markdown opportunity that is waiting to be unlocked by grocers. A dynamic markdown model is designed to produce a price that optimizes the chance of product sell-through and maximizes the product margin captured to find the product’s pricing ‘sweet spot’. A static markdown approach, on the other hand, means that the discounted prices are not optimized for volume or profit maximization.3

WasteInsight is an advanced dynamic markdown solution that reduces wastage by driving maximum sell-through on expiring products and minimizing loss.

Focus on On-Shelf Availability

In an age where instant gratification is the norm, customers expect their preferred products to be available where they want them, when they want them. Improving OSA (On-Shelf Availability) is integral not only to maintaining customer loyalty, but also to driving profitability and sustainable growth across sales channels (both on- and offline).

According to FMI (The Food Industry Association headquartered in Virginia, USA), the average out of stock rate for food retailers in 2022 was 10.7%4 - with the responses we received demonstrating the extent to which grocery retailers need solutions to the plethora of availability-related problems against which they continue to battle.

We identified two key groups that are negatively impacted by the issues that inferior product availability can cause. Whilst the two are intrinsically linked, the knock-on effects of poor OSA levels differ depending on the group in question.

Impact on Customers

Just 59% of those surveyed agree that their customers will be able to buy all of the items on their shopping list, first time, every time – threatening the loyalty of core customer groups and causing shopper migration, dissatisfaction and often higher prices for customers (many of whom are left with no choice but to purchase costlier alternatives to their preferred products).

27% of those surveyed are not confident that their customers think that shelf availability is good, indicating an awareness of the implications that sub-par OSA can cause.

Impact on Employees

With only 55% of those surveyed agreeing that they have a single reliable measurement for on-shelf availability – and just 60% agreeing that their store managers know OSA at all points during the day - there exists a clear requirement for a solution which guarantees a single version of the truth and enables an accurate exchange of information.

Our AvailabilityInsight solution takes retailer data and quickly turns it into actionable alerts that show where, when, and why items are not available – enabling smarter decisions, minimized out-of-stocks, higher levels of customer satisfaction and boosted sales.

Conclusion

Achieving the perfect store is difficult, but not impossible.

In recognising the importance of investing in technological solutions that can help to solve the issues faced at store level, retailers are taking a step in the right direction and making tangible efforts to enable their stores to reach their full potential.

Find out more about the numerous ways in which Retail Insight can help here.

1 https://www.skufood.com/2023/08/04/labour-is-the-biggest-controllable-expense-for-most-retailers/

2 Retail Insight research

3 Retail Insight, An examination of shelf health at US grocers, 2023

4 FMI, The Food Retailing Industry Speaks, 2023

Get in touch

Written by Irene Brockie

Irene is the Research Associate at Retail Insight, having joined the business from Mintel, where she specialised in creating insightful and in-depth content about retail industry issues and trends. She is originally from Ireland and holds a degree in English Literature and German from Trinity College, Dublin.

You might be interested in

An examination of shelf health at US grocers

How to maximize retail labor productivity

Why do grocery retailers find on-shelf availability such a challenge?

The growing significance of customer-centric merchandising

Counting to 10: How to tackle phantom inventory

What can grocery retailers do to help their customers manage inflation rates?

How East of England Co-op integrated prompted markdowns with ESELs

Six solutions to measure on-shelf availability in grocery retail

Latency in Data Kills On-Shelf Availability

How to reduce retail shrink and pinpoint the root cause